Location | Price | Bedrooms | Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Monday, April 27, 2009

Thursday, April 23, 2009

4 bed bungalow for sale

Monday, April 13, 2009

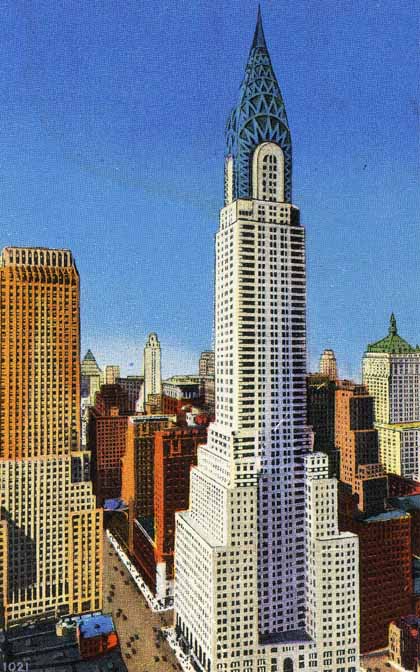

New york property for sale.

| Location | Price | Type | Size | Beds | Baths | Date | |

|---|---|---|---|---|---|---|---|

15 Photos 15 Photos | View DetailsSoutheast Annadale Neighborhood Info | $2,499,000 USDMLS ® | Residential | 7200 sq. ft. | 6 | 5 | Apr 11 |

13 Photos 13 Photos | View Details785-796 Jennings Street Bronx Neighborhood Info | $350,000 USD | Residential | 3900 sq. ft. | 8 | 3 | Apr 11 |

2 Photos 2 Photos | View Details1787 Ocean Avenue Brooklyn Heights Neighborhood Info | $975,000 USD | Commercial | 6 | 5 | Apr 11 | |

2 Photos 2 Photos | View Details1789 Ocean Avenue Brooklyn Heights Neighborhood Info | $925,000 USD | Other | 5 | 5 | Apr 11 | |

For Rent/Lease  7 Photos 7 Photos | View Details31-19 12th Street Long Island City Neighborhood Info | $3,300 USDMonthly | Commercial (Rent/Lease) | Apr 11 | |||

6 Photos 6 Photos | View DetailsBarker Ave North East Bronx Neighborhood Info | $514,000 USD | Residential | 2445 sq. ft. | 5 | 2 | Apr 10 |

13 Photos 13 Photos | View Details3760 Barnes ave 217th Street Neighborhood Info | $599,000 USDMLS ® | Residential | 8 | 3 | Apr 10 | |

2 Photos 2 Photos | View DetailsHeartland Village Neighborhood Info | $266,000 USD | Residential | 791 sq. ft. | 2 | 1 | Apr 10 |

| View Detailswest 90 street Central Park West Neighborhood Info | $3,195 USDMonthly | Residential (Rent/Lease) | 725 sq. ft. | 1 | 1 | Apr 10 | |

15 Photos 15 Photos | View DetailsAnnadale Neighborhood Info | $469,000 USDMLS ® | Residential | 1998 sq. ft. | 3 | 2 | Apr 10 |

Flat Iron Building, New York, Ny

New York home values

Finance values all New York City re sidential and commercialproperties.State and City real estate law and tax rates set each year by the City Council are applied to these property values to determine each homeowner's annual tax liability. The Department of Finance collects these property taxes and other property-relate d charges, maint ains title  records and tax maps, oversees lien sales, and administers the real estate transfer and mortgage recording taxes.

records and tax maps, oversees lien sales, and administers the real estate transfer and mortgage recording taxes.

- Valuation/Assessment

The Department of Finance releases a tentative assessment of the property value of every one of the approximately one million properties in New York City every January and final assessments every May, prior to the beginning of each tax year, which begins July 1st.

- Condominium/Cooperative Comparable Rental Income

The Department of Finance is required by State law to value condominiums or cooperatives as if they were residential rental apartment buildings. We use income and expense information from rental properties that are similar to the condominiums or cooperatives in physical features and location. We apply this income and expense data to the condominium or cooperative and determine it's value in the same way we value rental apartment buildings.

- Rolling Sales Update

Finance’s Rolling Sales File breaks down property sales information into several criteria so buyers and sellers can understand the value of real estate in New York City. Users can determine what properties in all five boroughs are being sold for based on any combination of criteria we included in our file, such as neighborhood, building type, and square footage.

- Tax Reduction & Rebate Programs

Finance administers programs that reduce property taxes and encourages new construction and renovation.

- Read more about Property Tax Rebate

- Bills and Payments

Finance mails the Statements of Account every quarter to each property summarizing all property-related charges.

- Refunds

Finance will apply certain credits towards delinquent or future charges unless the owner requests a refund.

- Rates and Other Charges

Finance is responsible for administering the majority of New York City tax programs, and also serves as the billing agent for a variety of charges and fees imposed by other City agencies and by New York State.

- Property Information

Finance maintains owner information for every property, income and expense information for income-producing properties, detailed tax maps of every land parcel, apportionments and mergers, as well as property transfer records by Borough, Block and Lot.

- Recording Documents

The City Register records and maintains an official record of transfers and filing interests in real and personal property (e.g., deeds, mortgages, mortgage satisfactions, and financing statements).

Thursday, April 2, 2009

Respondents ranked Istanbul

Survey respondents ranked Istanbul third for investment prospects, falling from first place last year as investors continue to seek opportunities in the city. Istanbul secured the top place for development prospects although investors are still concerned with the risk Istanbul brings, viewing it as the eighth riskiest city in which to invest.

The retail sector has once again been awarded the top spot among property types for investment prospects, only just hanging on to the top spot with the hotel sector following closely behind. Economic development will determine just how rewarding these investments will be. Moscow is the most favoured investment spot amongst the major European cities and nearly half of all respondents regard it as a ‘buy’. Munich, Warsaw, Hamburg and Istanbul also earn marshal investor support. Markets with the highest sell rating include Dublin, Prague, Athens and Madrid and investors are urged to proceed with caution.

ULI’s European president William Kistler

According to the report, Germany was seen as less volatile with more long-term investors. "The German real estate market is becoming more attractive in the crisis," Helmut Trappmann, head of real estate at PwC, told reporters in Frankfurt. "Acceptable returns make the risks considerably lower here then in the boom regions in earlier years."

Best prospects for real estate

3 February 2009: With property values tumbling in the UK, Ireland and Spain as well as in many Eastern European countries, German cities emerge as the new favourites among European property investors. Real estate experts say that German cities are now the most promising and safest ones in Europe to invest in. A survey by the Urban Land Institute and PricewaterhouseCoopers (PwC) places four German cities among Europe’s top ten. Munich and Hamburg are awarded the top two spots, with Berlin and Frankfurt ranked nine and ten respectively.

European investors, developers, bankers, and brokers ranked Munich top of the investment market league table due to a combination of factors including: an increase in government spending, which may lead to future economic growth; the decline in unemployment; a fast growing population and increased consumer spending power. Munich also came top of the European City Risk league table. Munich is seen as having low risk because of its diverse economic base, which mitigates risky investments. Indeed Germany is considered ‘less volatile with more long-term investors’ helping Hamburg to second place with Frankfurt and Berlin also ranking among the top ten for investment prospects in 2009.

However the authors of the survey Emerging Trends in Real Estate Europe, 2009 point out that the investment climate in all major European cities had fallen. “This is going to be a tough year for many investors. For those who bought at the top of the market it could be a struggle for survival, particularly if banks become more aggressive in dealing with covenant breaches. On the other hand for those with equity to invest, there will be opportunities as the banks start to take action. Although new debt will remain in very short supply, banks may have little alternative to remaining as lenders during the restructuring of defaulting borrowers,” said PwC real estate director John Forbes.

Investment and development prospects fell for all of the cities ranked in the report, with overall investment prospects dropping from a rating of 5.6 (modestly good) in 2008 to 4.7 (fair) in 2009. Developments prospects fell even further, from 5.6 to 4.3 (modestly poor). Risk ratings have also worsened.